According to Benjamin Graham, “An investment operation is one which, upon thorough analysis promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.”

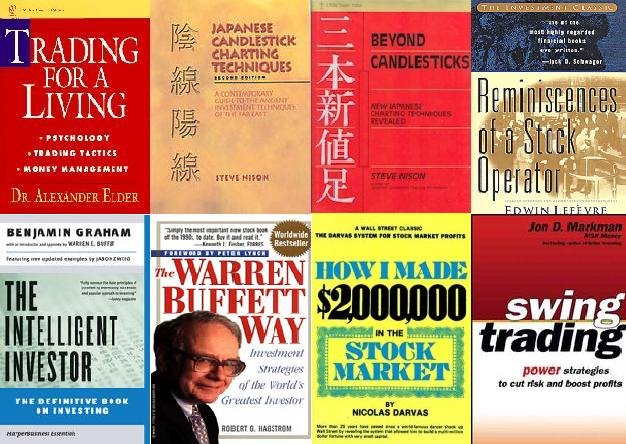

A trader would need to have at least the following:

1) Trading system which has more than 50% probability.

2) Emotional control - much like what is emphasized by Graham as well though a slight change is needed.

3) Discipline to carry out stop loss and to trade as per the trading system.

And with these three, it would fit to Graham's definition of investment which "promises safety of principal and an adequate return"

1) Why safety - Money management techniques would safeguard the trades/trader, limiting the exposure or risk taken. This is normally in two folds - one in the form of stop loss. Another is the size of the trade, hence no overtrading is done.

2.) Adequate return - The system which has more than 50% accuracy. And with emotional control to execute the system, adequate return will be guaranteed over the long run. Law of averages promises this.

Allow me to share with you a video which would depict what’s on my mind. Oh, for those who do not understand Cantonese, please accept my apologies.

No comments:

Post a Comment