Few days ago, I made a post - Why bother to trade?

I structured the post in such a way, which I think depicts the truths of trading and also provocative. While the total number of comments reached 18 comments, as at the time this post is being made, there is only a handful of people who commented. Which, I appreciate the comments made though, I am disappointed at the number of people who actually commented.

For the benefit of everyone, I would be putting down the definition of investing, trading, speculating and gambling. They are my definition and by no means correct, but they re my definition which I use.

Graham has a definition too. Let's look at Benjamin Graham's definition first.

What do we mean by “investor”? Throughout this book the term will be used in contradistinction to “speculator.” As far back as 1934, in our textbook Security Analysis,1 we attempted a precise formulation of the difference between the two, as follows: “An investment operation is one which, upon thorough analysis promises

safety of principal and an adequate return. Operations not meeting these requirements are speculative.”

And also, the commentary,

What exactly does Graham mean by an “intelligent” investor? Back in the first edition of this book, Graham defines the term—and he makes it clear that this kind of intelligence has nothing to do with IQ or SAT scores. It simply means being patient, disciplined, and eager to learn; you must also be able to harness your emotions and think for yourself. This kind of intelligence, explains Graham, “is a trait more of the character than of the brain.”

I dislike the definition as it does not distinguish trading from investing. Trading would include

1) A trading system with more than 50% accuracy.

2) Emotional control - much like what is emphasized by Graham as well though a slight change is needed.

3) Discipline to carry out stop loss and to trade as per the trading system.

This would satisfy Graham's criteria for as an investment which "Promises safety of capital and an adequate return"

1. Why safety - Money management techniques would safeguard the trades/trader, limiting the exposure or risk taken. This is normally in two folds - one in the form of stop loss. Another is the size of the trade, hence no overtrading is done.

2. Adequate return - The system which has more than 50% accuracy. And with emotional control to execute the system, adequate return will be guaranteed over the long run. Law of averages promises this.

So let's return to my definition. But as I ve mentioned, they are my definition and by no means correct, but they re my definition which I use.

Investment - Long term venture with intention to purchase the business or part of the business. Mindset here is as a shareholder of the company. While a shareholder mindset investor may dispose the investment in short period, this should not be an active pursuit. An investor should have the mindset of letting the business grow, otherwise, he wouldn't venture into it in the first place. Having run my own business before, I could tell you from experience, a business needs time to grow, things definitely do not happen instantly. An investor should be able to see the long term prospect of the company and base his decision on that.

Trading - A short term venture whose intention is to capitalise on the short term swings of the market. There is NO intention to be a shareholder. Objective is speed - not being an owner. While a trader may go for long term, it should not be a buy and hold strategy. Otherwise, it would be an investment. Yes, a Turtle Trading strategy would be difficult to differentiate whether it is a trade or an investment.

Speculation - While many have their own definition of speculation, my definition is being an operator. By this I mean to be able to "control" or influence the prices of a certain stock and enticing others to jump in on the wagon would be considered speculation. This is a highly specialized area where enormous amount of cash meets with the highest degree of skills.

Gambling - By gambling, I refer to the 90% of the market population. By jumping into a counter just because it is climbing up or just because it has shed 60% of its value is gambling. Why? Under what basis does one know that the trend will continue or will reverse? Without proper technique, its a gamble as there is no analysis nor any work done to justify the entry.

Majority of people also merely follow a tip. That would be gambling - no analysis done on the individual's part - no basis other than following the recommendation. The gamble is that the recommendation is correct. That is gambling.

Note: Even if I give certain recommendation, do make your own analysis and then derive on your own decision - then it could be either trading or investing. If you do not conduct your own analysis to ascertain the true picture of it, you re merely gambling that my recommendation is correct. I am known to be wrong. Everyone is known to be wrong. I ve yet to met anyone to be 100% correct. Show me one person who is 100% right all the time, and I ll show you a liar.

Then there are those who claimed to be traders but do not have a trading system - then they re not trading, they re effectively gambling. Without a system that works with the Law of Averages, there is NO safety. Hence - gambling.

Therefore, if there is no money management techniques incorporated into the trade entry, its gambling as well - NO money management concept - NO safety - GAMBLING.

~to be continued...

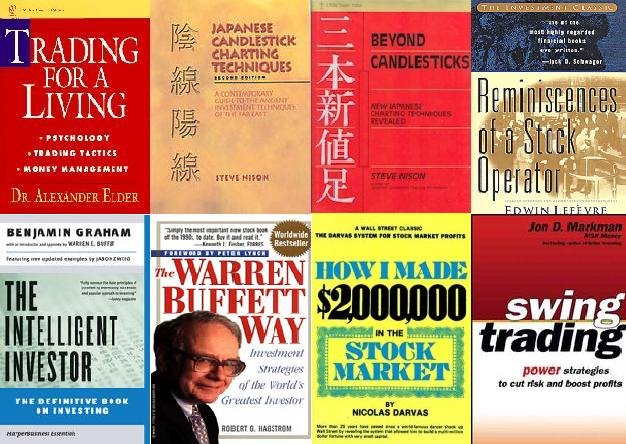

Further reading suggested on previous posts:

Gambling; Buy, Pray and Hold; Investing and Trading

Of Trader and Gambler

13 comments:

Hi Max,

Your explanation in investment,trading and gambling had been layout in this article.

For us to understand further can u let us know what is the technique or assessment you employed in arriving to a decision of 1)purchasing a particular stock,2)your decision of positioning sizing,3)your decision on holding period,4)when will u dispose the share ?

Technique as mentioned is irrelevant as they re methods, so the definition on activity stands.

My technique is simple - a fusion of TA branches and a concoction of FA as well.

My position sizing is standard size of a certain percentage of my capital (trading fund).

Decision on holding period depends on nature of stock, reason of entry, and general concept of cutting losses and letting profit run.

Disposal depends on holding period :)

Methods are important bcos this govern our investment/trading strategy & this is basis of our argument.

My view are as follows;

1)investment-A pure investment approach is to look into pure financial figures and business and make deduction of the investable value of the share.Conservative look into historical and more aggressive look into prospective.

2)Speculation is buying into something in an anticipation some events will happen that will upgrade the overall value.For an investor he would not buy this counter if it is based on pure financial analysis if not for potential for occurence of the events that may bring up the price.Stock operations may be one event, getting project,price hike,shortage, revaluation of properties,takeover..etc

3)Trading buying stock based on demand/ supply action through chart reading,momentum or some expected events(can also be speculations)and the trader expect can dispose higher price.Generally a trader feel his technique from experience has positive expected value of more than 50%.Although scientifically quite difficult to determine.

4)Gambling the person is indulging in a game of chance with negative expected value for ie)empat ekor,genting,horse betting.Although statistically computed as negative expected return the diehard gambler still claim he is different and he has some techniques to beat the odds.Sometime the gambling technique is mixed up with trading resulting in buyer buying as a pretext of trading but actually gambling-as his trading technique may be flawed.The trading and gambling technique is quite closed as there almost face the similiar environment of fast movement but the only different is one suppose to be positive expected value and the other negative expected value.

Stock operations-A technigue to manipulate the mkt through price/volume actions and rumours or news release to entice followers to invest in the stocks.

Thank you for your definition.

Here's why technique is unimportant. Lets use back your example (previous post) where an "investor" buys into a certain share at 3.00 based on FA. Within 3 days, the stock appreciated to 3.50.

The investor sells and switch to another "undervalued" stock at 2.00 per share. Again within 3 days, the share price appreciated to 3.00.

Then the investor switch to another at 5.00 per share, within a week, it flew to 5.90.

Again the investor identified another opportunity, what happens next? Yeap, you guessed it, he switches again.

Would you call this investment? Seriously, I call it trade.

TA based on supply and demand is inaccurate or so implied? Perhaps, but then so is the valuation provided by FA. FA is a self fullfilling prophecy - in the sense it waits for others to demand for the stock - otherwise, FA would not work.

Say a stock is undervalued at 3.00, intrinsic is 6.00 but somehow there is no demand. What happens? The stock stays at 3.00. While it is indeed undervalued, it would not move unless there is a demand.

TA does not value stocks the way FA does. TA values stocks in terms of what others may be willing to pay - would this be inaccurate? Yeap. But how accurate would FA be - when it disregards what others may be willing to pay?

Not very accurate either.

Both TA and FA has its strengths and weaknesses. But in any case they are merely techniques. Usage of techniques cannot constitute as trading nor investing.

Your example is not representative bcos if someone can continously buying and selling stock at a profit within a short period, he would have the best system in the world whether u are a tA or Fa it is to your advantage to adopt it.

Let get back to basic when we buy a stock there must be an underlying reasons or system that support our decision to invest this is most fundamental to investment/trading strategy.

Investment will adopt a financial Analysis strategy and his rationale is that he buying into a business which yield good value.He will sell when the businesss deteriorate or when he find better alternative investment.He is not concern with the daily share price movement as stock price is only reference for him to take advantage of.

Stock price can be suspended for the next 2 years and his investment can still stand the test as he still got dividend etc...

A trader buy on the premise that he can unload to another person at a higher price based on some some system linked to supply/demand action to but sometime it does not turn out right-he trade at a loss.Always the trader claims that his system has more than 50% success rate, but most of the system is not mathmatically proven.Trading is actually an art.

However bcos of the trading weak anchor some gamblers also claims he has a good system and operate a system similiar to the traders trading system although the transactions he has done has a negative expected value he still ocassionally beat the odds .

Hence based on the 2 methods between trading and gambling there is only thin line to differentiate a traders and gambling system.

Allow me to focus on your statement below:

[i]Your example is not representative bcos if someone can continously buying and selling stock at a profit within a short period, he would have the best system in the world whether u are a tA or Fa it is to your advantage to adopt it.[/i]

Best advantage to adopt it? Exactly, but would it be trading or investing? If one could keep buying and selling generating consistent profit within a relatively short time - say within a few days.

What about scalping - where one could generate consistent profits by buying and selling within very short time frame - ie minutes?

Trading or Investing?

Gambling? You kidding?

Then next we go to your other statements -

[i]A trader buy on the premise that he can unload to another person at a higher price based on some some system linked to supply/demand action to but sometime it does not turn out right-he trade at a loss.[/i]

Same with investor - wishing to unload to someone who would pay higher but dont always do right?

[i]Always the trader claims that his system has more than 50% success rate, but most of the system is not mathematically proven.Trading is actually an art.[/i]

I think you may have missed my point on Law of Averages. Also, a system can be tested by statistically via software - e.g. Metastock System Tester. Therefore your claim is not substantiated.

But I agree that Trading indeed in the end is an art, but then, so is valuation - assumptions are made and it is not an exact science on how to make the right assumption. Its more of an art, dont you agree?

[i]However bcos of the trading weak anchor some gamblers also claims he has a good system and operate a system similiar to the traders trading system although the transactions he has done has a negative expected value he still ocassionally beat the odds .[/i]

The media uses the term investor to mean the general public who participates in the equity market. Does it mean that they are really investors?

Misconceptions as per Graham. The term "trader" suffered the same fate - misconstrued and misunderstood - most in the hands of Hollywood.

[i]Hence based on the 2 methods between trading and gambling there is only thin line to differentiate a traders and gambling system.[/i]

Don't be too quick to judge, yours truly is an investor turned trader.

1)real scenario not everytime winlah! sometime also lose.Too good to be true esp short period.

2)The law average stats if u look at Warren Buffet national coin tossing illustration,the stats may show temp bias-even where in the case where we know it is an always 50:50.Based on pure luck if a monkey also participate he may be also be the national champion.I m not saying TA is based on luck but mathematically it is not proven yet.FA although is also an art but it is a universally accepted principle for example u need to get the auditor to sign financial statement,banks will look into account to lend to business,IRB will tax business based on a/c.

There are millions of people study the subject-a/c although there may be diff but it always being tackled.

3)I agree media has missed classified all as investor in fact there are many type but this is the most acceptable n non-controversial terms.Graham is correct he classify trader that do not make use of the fA to appraise the share value this clearly draw the line.

4)In summary if someone who make use of TA to buy stock highly overvalue stocks, there is little to separate from gambling.In this case bcos he make use of stats-TA u can call it intelligent gambling.But if u have done some FA analysis to support your decision then u have weighed the risk, this approach can be investment as u have determine your risk/reward situation.

Hi Max,

I'm glad to see you've finally defined "investment", "trading", "speculating" and "gambling". I have minor differences in the definitions, but they are not practically important to 99% of the readers here. What is more important from the practical perspective is that you've also defined "gambling", and allude to the potential dangers of gambling. That I wholeheartedly agree. If one wants to gamble, don't bet the entire house on it.

Cheers,

Grahamsmun,

1) Try not to focus on everytime win - question is if one uses FA but has more than 50% of winning and able to buy and sell in short timeframe - eg one week, and has no intention to be a shareholder of the company per se, would it be an investment or a trade?

Simple question - to illustrate that method and activity is differentiated.

2) Friend, just mentioned to you already - Metastock Exploration. Backtesting - which statistically prove that a particular TA system has more than 50% accuracy.

In any case, 50:50 is inaccurate. If you subscribe to Random Walk Theory, it should be 33.3% - stock either goes up, down or sideways :P

Fact that valuation is used by many is irrelevant - the point was its as much as an art as TA. Example, how would you value a business? NTA? FCF? DCF? EPS? All will give you different results. Which one is right? Which one to use? Point is still - FA is an art.

By the way, have I mentioned I m an accountant too ;)

3) Strongly disagree on part Graham classification - note that we started off with Graham's definition of investor of which - traders of my definition fit into his definition. In addition, Graham was never a trader (well no evidence of such anyway), therefore the probability that he does not understand traders and mistaken them for gamblers is very high.

4) Again, I disagree - Let me put the scenario again:

- Highly overvalued stock

- Use of TA = gambling

- Use of FA + weigh risk = investment as risk reward ratio known.

Friend,

Where have you been when we started this debate?

A trade will have risk reward ratio via the trading system. One would have assessed the risk via trading system. And there is Money Management techniques to safeguard - thereby limiting the risk.

TA is merely a method of valuation, FA is another method of valuation.

TA would have identified -

1) Is there a buying signal (ie likelihood that price will continue to be higher)

2) Where is the resistance (ie where people will think its too expensive)

3) How likely is this resistance going to be taken out? (ie likelihood there will be more buyers who values the stock at higher price)

4) If so, when? (estimated timeframe)

5) Where is support? (supposed there is a selling pressure, where would buyers emerge?)

6) Would this support stand? (likelihood buyers will absorb selling pressure)

7) How would this analysis considered wrong? (Under what cricumstances would the market valuation via price movement proves that this analysis is done in error) - hence stop loss is set near this price.

etc etc etc, Grahamsmun, not easy being a trader, you know, we calculate all these stuff - which will maximise our gain, and minimise our losses. Its risk reward assessment too - look around in forums, you ll see many traders advising entry or non entry because risk reward ratio is appealing or non appealing.

Sometimes, while there is further upside potential, we do not trade. We let it go - we deem its too risky for the small profit.

Seng,

Glad to see you here :)

I m sure we ll continue to have our differences, afterall, we re two unique individuals. And that makes life interesting.

Cheers!

Wow Max,

I have read many, many lines of words and I am still waiting for you to shed some light on why you trade. How much more do you have to write before you start telling us why do you really want to trade? The suspense is killing me :p

I guess I should tell you mine first. I trade securities because I have some knowledge about them and they offer me an addtional avenue to generate income to support my lifestyle.

Hahahahahahahaha Marc, loved your sense of humor. Will write soon :)

I think our argument have gone through many round and we are back to square one.

I think it is very difficult to argue out,as there are relative merits and we come from a different perspective.

Having said that the investment and trading system both had its relative advantages.

Depending on individual inclination,skills and interest each individual should look into the suitability of his system.

Please regular monitor and fine tune your system regularly and ultimately u will find a successful tailor system that suit your needs.

For continous improvement,it is also important look into the available good practise and see whether can be incorporated to your current system.It does not matter is TA or FA.

Happy Investment/Trading!

Post a Comment