Wednesday, May 16, 2007

End of a Chapter

Dearest friends, bloggers and passer-bys,

Its been two months since I started this blog and with great sadness, I am closing this blogging chapter of my trading journey. I sincerely thank everyone for their support either by participation or just reading the articles posted here. I noticed its even a breakout - 10,000 hits :).

After meeting the masters over the weekend, I realised the disparity is great, so great that I am left with no choice but to close this blog to find time. Time to strengthen my foundation, time to relearn what I have learned, time to unlearn what I have learned, time to get in tune with Nature.

Final Notes of My Stand

Luck

I do not know about luck but I know this - Luck is when Preparation meets with Opportunity. Yes, I have emphasized a lot about Preparations over and over again in my blog. Without proper preparation, one cannot capitalise on opportunities that arise. What is the will to win, if there is no will to prepare?

Continuous Learning

I have yet to meet with a master that thinks that no more learning is needed. A true master would never stop learning. The three masters I met have such high level of skill and yet, they are discovering new things each day. They have yet to stop learning, they knew one thing - when they took on this path, this trader's path, they have made the market their best teacher and vowed to continuously learn from it.

I have always correct anyone who tried to call me sifu. I know that they only meant respect or maybe out of politeness but seriously, I am unworthy. I have yet to attain such level of skill. I have yet to achieve anything that is worth shouting about. I have to decline the title.

Trading Plan

Before a trade is even made, a trading plan MUST, I repeat, MUST be drawn up. Else, one would be at serious disadvantage. In the market, we are up against people with more money than we have, more skill than we have. How can we possibly stand a chance if we do not even have a plan?

Stop Loss and Trailing Stops

To me, this is imperative, irregardless whether one is a trader or an investor. Perhaps the stop point would be different, but nonetheless, this is a life saver. Anyone who lived through the recession periods would understand this concept. Or they better do.

Even the most fundamentally strong company would not be spared. To watch your investment decline 80% of its value is not an easy sight. And it tests every bone of your body as an investor. Yes, the stock is undervalued but it may remain so. Yes, it will rebound - some day but you may need the cash. You may get retrenched, your children may need to further their studies, there could be other emergencies, countless and endless possibilities. In recession, Cash is King.

Average Down

I have not recommended anyone to average down. Its like compounding the initial error. Now, what about investors, should they average down? I do not know about shoulds or shouldn'ts but I know this - you may average down SUBJECTED TO identification of critical points where beyond would render the average down and the initial entry wrong and stop loss MUST be executed - this means an impeccable discipline and emotional control.

Feel the Market

Several months earlier, I was chatting with booffett - who draws chart with pen and graph paper. It was my lack of understanding that computers could replace this function. I am beginning to appreciate drawing charts by hand. I am drawing 50 charts per day by hand and I hope to increase this number. ;)

Nature

I speak about Nature. It may be too complicated to explain but remember the most important indicators where all are derived from - Price, Volume and Time.

Price, Volume and Time. Master this and the world will be your oyster.

Moving forward

For Fusion Picks - which I must add was not really successful, remember to place stops and trade according to initial plan.

Market - From what I see, the general KLSE is weak, while KLCI is strong. Bullish uptrend is expected to continue despite May Factor etc. However, remember your stops. Never forget them.

Stocks - KLCI or related should perform and give a better chance of success.

Futures - Well, doubt futures traders would find any comment from me useful. See you in battlefield :P.

Resources

There are many resources around on the net - this means tremendous savings in money - rather than buy books or attending seminars, one could read and learn by themselves. The money would be better spent paying for tuition to the market.

Kenneth Factor

Just in case anyone thought this is for Kenneth Factor, do visit this link - under the comments section. I take this as a peace treaty signed between Kenneth and myself. I have nothing further to add.

Steps

Brian McKnight has this song - Back At One. For trading there are steps too:

1) Learn

2) Analyse

3) Backtest

4) Foreward Test

5) Trade

6) Post Mortem

7) Back to (1)

And to Make Money from Trading

All that is needed is this -

1) Trading System

2) Emotional Control

3) Money Management and Discipline

Oh, if anyone is looking for me

I ll be around in forums, or you could mail me directly. :)

Once again, thank you everyone for your kind support and patronage.

Good Luck and Happy Trading!

Saturday, May 12, 2007

Meeting the Masters

Dearest bloggers,

For the past few days, there have been a lack of updates in this blog.

I would like to take this opportunity to thank everyone who still come and visit daily and also apologize for the lack of updates. Reason is I have been making some preparations to meet with three master traders during the weekend. I believe that the visits would be fruitful and I may be able to advance another level in TA.

Of course, once I am back, I will be updating the blog.

Stay tuned :)

Thursday, May 10, 2007

Comment Moderation

And so, most of you would have known about this Kenneth character.

And regretfully, due to this, I must enable comment moderation.

Only Kenneth's spam of same message over and over again using multiple names will be filtered.

This applies to both Fusion Trader and Fusion Pick blogs.

What this comment moderation means is that each time a comment is posted, I would need to allow the comment to be published. So there would be delay in seeing comments published.

So what is with this Kenneth character?

Well, the summary of chronology is this:

In a Google group called Bursamaster, the owner made a buy call from 0.26.

By end of the day, it shot up to 0.33.

He maintained his buy call, but the following day, it closed 0.305 followed by the next day 0.325 followed by 0.31. With these consolidation signals and supposingly some news that this counter would not be moving soon, the owner Bursamaster issued a sell call.

Come another commenter Sunny to ask everyone to hold the stock. And average down if price falls any further. Prices continue to fall. And when the people there asks about Infotec, came several other comments to ask to hold. Prices will not fall beyond 0.25 was the comment.

But it did. And when questioned about it, the answer was buying support comes from below 0.25.

I pointed out the simple trading rules - Never Average Down. Cut your losses.

Kenneth disregard, and question the practical usage of the trading rules I ve mentioned.

Thereafter he continued to encourage everyone to hold, and average down.

Today it close 0.22.

Someone by the name of Kaza, found out that the comments to ask to hold and to average down - Sunny, Kenneth, and many others, was in fact the same person - by virtue of using the same IP Address.

Kenneth tried to divert the attention and allege that Bursamaster, Kaza and myself are the same person - by virtue of Bursamaster suggested stop loss - which I supported as best course of action - and the fact that Kaza exposed him. So it must be same person, or so he claims.

Subsequently, he came over to spam my blog and continued to spam in Ben's chatbox as well.

Sample of his spam (which are all the same, so I deleted most of it) could be seen in 2 previous posts before this one.

For those who are interested of the Bursamaster's Google Group, the link is here

http://groups.google.com/group/bursamaster

Thank you guys for all your support and jumping to my defence.

I sincerely appreciate it and would do my best to share more of what little TA knowledge I have.

Once again, thank you. :)

PS: Thank you Kenneth to you as well, for without you, my traffic counter would not have broken the 9,000 mark today :)

Tuesday, May 8, 2007

Fusion Pick Launched

OK, so finally I decided to blog about my picks. :P

Yeah, slightly overdue but oh well...

Enjoy and don't forget to read my disclaimers.

I ll post the disclaimer all around Fusion Pick when I find the time.

Friday, May 4, 2007

Why do I Trade? Part 4: The Trader's Path

I am a trader. I realised that I ve always been a trader - only that I did not realise until I was tested. And someone once said, "Man are like teabags, you will never know how strong he is until he gets into hot water". How true this is. Without being tested as I had (as mentioned in my previous post), I would never have known that I am a trader.

Money is not the main objective for me now. I know for a fact that I could trade for a living. I know that once I ve conquered the pain that I endured. I know that the experience though painful was there for a reason - to serve as a reminder not to be complacent and disregard the trading rules. To follow my own trading plan. To give me the strength that I need each and every time, that I must execute the inevitable stops. I ve grown and became wiser, though I ve yet to attain the wisdom that many readers of this blog has. I ve still much to learn.

One may wonder, could I have avoided the disaster should I have met with the wise people I met on the net? Whose wisdom I ve always revered? If previously, I ve met people like Ben, Lsb, Theng and Csong? To be frank, I doubted very much. Some lessons have to learned the hard way. Some mistakes need to be learned in order for one not to forget. Some experience is needed for one to advance to another level.

Today, when I trade, I look at points, I look at percentage. I really do not have much idea how much profit or loss I ve made until I close the books. I find by looking at points or percentage, I trade better. Perhaps there is less connection with the $$$, perhaps, I really do not know. But this is the manner I trade now.

But why do I still trade - Money? Freedom? Well, I ll be honest with you, they have bearings, and weightage to it. Its like once you ve tasted the money, you re tainted. Its most difficult not to be addicted. But there is considerable risks with a mere trading for money mentality, as evidenced by my horrifying experience.

Freedom? Well, I ve long know that I cannot work for others. I m a perfectionist. Perhaps the word is too strong but consider this - when I make a decision, I placed the highest importance for the betterment of the organisation. One may think, yeah this should be the way. But then, in reality, this is not the way. When top management makes a decision, the number one consideration is being placed in satisfaction of certain parties. Yes, I am referring to office politics. I, for one, when given the authority to make decision, does not bow to these inefficient, ineffective practices. When traveling, I do not buy wine for bosses, I do not lick boots, though my crime would involved laughing at boss' stale jokes during meetings, lunches or dinners.

Therefore, with such mentality and holding such principles, I am really not suited in the corporate world, particularly MNCs. However, I am not looking at trading merely as a means to be free from what I am not suited for. While I may be unsuitable for the corporate world, it does not automatically mean that I am suitable for trading.

Some of you may have heard me mentioning about "the charts talk to me". While I do not want to give an impression that I am a mad person, or I am talking bullshit, I feel a "certain connection" when I look at charts. And it is a feeling which I could not describe other than saying that the charts speak to me. I could as if hear the charts telling me the direction of where it is heading. OK, I realised I am beginning to sound like a lunatic. So I shall not continue about it.

But the long and short, I enjoy looking at charts, deciphering the hidden meanings. While doing something I enjoy, what's more, I could actually make some money out of it. Isn't it just perfect? Doing something you enjoy while able to make money out of it? To the end, why do I trade? Its the love of the game - love of trading itself. :)

And why is this important? Otherwise, when met with huge profits, I would be overly excited while when met with huge losses, I would be overly depressed. To which, both is detrimental to trading. There should be another motive behind the money making objective to trade. That said,

Good Luck and Happy Trading!

EDIT: For MTV - Told you its Youtube Mania here :)

This one by Clay Aiken, supposingly an American Idol (sorry, I don't watch :P)

Why do I Trade? Part 3: Pain

I watched Grey's Anatomy the other day (I seldom watch the television by the way), and it was this one episode about a little girl who thought she was a superhero. She could feel no pain no matter the seriousness of the injury. Of course, she was not a superhero, it was some scientific disease or something where one could not feel pain. I could not remember what symptom it was called (Hehe, I m a trader, not a doctor).

But due to this illness, the girl kept asking everyone to punch her in the stomach to prove that she has superpowers (hence no pain). And the doctors found out that she was suffering from internal bleeding.

At the end of the episode, the narrator said something to the effect of,

"We all want to live a life without pain, but we forget the very reason why we feel pain"

In my previous post, I described the euphoria of making money - of feeling like I am some sort of genius in trading. However, this was far from the truth. Very far. While I have discovered knowledge, I have yet to acquire wisdom. I was ready to make big money but I was not worthy of keeping it. I sinned.

No, not the typical sin - but trading sins. I overtraded. Would the concept of trading one lot be the same as trading 10 lots? Or 100 lots? Logically, it would appear so. However, we know its not true. Yet, when you ve just discovered your own holy grail, you feel invincible. I mean, why wouldn't you? Out of 10 trades, 9 trades are big wins, while there's one minuscule trade is stopped. What could go wrong with a superb system like that?

The trader, unfortunately. It always boils down to either the people or the system. When something goes wrong, look no further, its either the system or the people. Often, its the people. Afterall, people are the ones who set the system anyway. This is true for trading, this is true for all things in life.

The phenomenal rise, ended with a phenomenal fall.

Once I overtraded and things did not go as what I foresee, I could not be my usual self. While my system says, stop, I went on to commit another trading sin - averaging down. As I average down further, the more I could not execute stop loss. I then risk even more funds into a losing position - this is in direct violation again to not commit more than 20% of trading capital into one trade. Ultimately, when things still did not go my way, I plunged into the worst sin - revenge trade. At the end of the day, I lost much. I was barely saved from being a bankrupt. But what was worse, was that I lost my confidence to trade.

I could not look at the market. I could not see the screen. A mere mention of anything remotely similar to stock market would be tantamount to taking a knife and cutting a part of me. The pain was excruciating. I could not sleep. I could not sit. I could not eat. I could not do anything. When I talk, my voice was quivering. My knees were weak, my hands shivering. I became a living zombie. No one could console me as I could not concentrate on what they were talking. In my mind, the whole scene just repeat itself in a neverending loop. The torture of living the mistake over and over again was just too much. How? Why? How and why could this happen to me?

It was a difficult time for myself. Perhaps it was a difficult for others but it was not my concern. I wasn't capable of being concerned of anything during that time anyway. The story could have ended here, indeed, for many it would have, but this is not how the story ends. It continues...

~to be continued...

And here's a little music video from a band called Simple Plan to add to the drama. Enjoy!

Wednesday, May 2, 2007

Will HOT Commodities stay as the world economy slows?

The past three global recessions were all triggered by high oil prices due to oil supply disruptions: the OPEC oil embargo in 1973-74; the Iranian revolution in 1979; and

These have led me to believe that a commodities super cycle is underway. A super cycle is a prolonged (decade or more) trend rise in real commodity prices, driven by urbanization and industrialisation of a major economy (according to Citigroup’s Report:

According to the IMF World Economic Outlook, September 2006, China accounted for at least half of the increased demand for industrial metals - Zinc (113%), Lead (110%), Nickel (87%), Tin (86%), Steel (54%), Copper (51%), Aluminium (48%) - between 2002 and 2005. In 2004,

Jim Rogers, the best known advocate of HOT commodities, laid out that a secular bull market in commodities is underway, in as early as 2004, when his HOT Commodities was published in 2004. He observes that the 20th century has seen three secular bull markets in commodities (1906-1923, 1933-1955, and 1968-1982). Each of those secular bull markets has lasted a little more than 17 years. If his view holds, we are currently in the middle of yet another secular bull market in commodities that began in 1999.

So, will the boom continue as the world economy slows? US, being the largest importer of

| Table 1: Selected Commodities Price Increase | ||

| change since January 1999 (%) | | |

| | Nominal | Real |

| Nickel | 1,093 | 856 |

| Uranium | 954 | 745 |

| Crude oil | 436 | 329 |

| Copper | 338 | 251 |

| Lead | 281 | 206 |

| Rubber | 239 | 172 |

| Zinc | 239 | 171 |

| Tin | 162 | 110 |

| Gold | 125 | 89 |

| Aluminium | 121 | 77 |

| Corn | 75 | 41 |

| Hard logs | 66 | 33 |

| Wheat | 59 | 27 |

| Soybeans | 41 | 13 |

| Soyoil | 41 | 13 |

| Coffee beans | 26 | 2 |

| Cotton | 4 | -16 |

| Palm oil | -2 | -22 |

| Sugar | -6 | -25 |

Perhaps it’s good to draw some inference from the historical prices of commodities – gold, tin, lead, copper, cotton, hard logs, crude oil, uranium, zinc, aluminium, nickel, soybeans, soyoil, corn, wheat, palm oil, rubber, sugar and coffee beans – in real (adjusted for inflation) and current prices. From January 1999 to Mar 2007, nickel increased the most, by a stunning 1093%, uranium 954% and crude oil 436% in nominal terms (see table 1).

Although we have always thought that copper is very expensive, it has only risen by 338% over the same period and a 251% increase in real prices. Interestingly, the figures suggest why Jim Rogers are so bullish on agricultural commodities. After adjusting for inflation, they are ranked at the bottom of the table, showing the least increase or decline (cotton, palm oil and sugar) in the past few years. Palm oil looks really cheap, down 2% from 1999’s level at current prices and 22% in real terms. Figure 2 suggests palm oil should go up to USD1,600 to surpass its previous high recorded in May 1984. At current price of RM2,300 (USD673) per tonne, it is 55-60% off from the previous high or equivalent to 1.3 times of its current price.

Another important thing to note is that copper, nickel, zinc and uranium are at or close to their historic highs. One common characteristic among them is that they are in tight supply despite rising prices (but the world sees IPOs everyday). In the mining industry, it takes years of exploration before one can bring the metals out of the ground and most mining companies are not willing to spend hugely in an investment that might not result in any tangible output for at least a decade. The same goes for other commodities. For example, it takes 5 years for a coffee tree to mature. It is still very much a fundamental play in commodities markets. Some commodities are not cheap but some are. Commodities do not move in tandem. Each commodity has its own supply-demand equation, though some may be directly correlated with other commodities, e.g. a palm oil might be related to soybeans, soyoil, ethanol and crude oil. One needs to study the fundamentals driving the supply and demand of a commodity before investing in commodities.

This article is posted on behalf of Vola due to technicalities in posting, I think.

Tuesday, May 1, 2007

Why do I Trade? Part 2: The Best Business

I was chatting with Mr CS Ong the other day and he mentioned that Trading is the Best Business. And I am inclined to agree. Trading should be viewed and conducted in a businesslike manner. But unlike conventional businesses, there is nothing one could just pack the bags and leave should one decides to. And once the skill is mastered, one could trade in any market. You need not be at a fixed location as like what a conventional business would require you to. And as Mr Lsb mentioned in the original post of Why Bother to Trade?, unlike conventional businesses, there is no need to manage assets and other people, etc.

And business, as we know, is somewhat synonymous to freedom. Mr Kiyosaki of Rich Dad and Poor Dad fame, has an interesting audio (Freedom or Security) which you could hear to demonstrate the point of freedom.

Somewhere in the 14th minute, the excerpt is as follows:

People who tries to find security are actually selling their freedom down the tube. Because the people that found this country, who fought the revolutionary war did not fight for job security. They fought for the right to be free. And freedom is a very, very high state...

How in the world can you say you have freedom when somebody tells you when you can eat lunch? How in the world can you say you have freedom when somebody tells you when you go to work and when you get off work? How in the world can you say you have freedom when somebody tells you when somebody have the right to fire you because they need to downsize?

when somebody has the right to tell you how much you can make? That is not what we fought for. Too many people has sold their freedom...

Of which, I am sure Mr Zewt would be inclined to agree with Mr Kiyosaki with his numerous postings on Modern Slavery.

And the key point as earlier mentioned was the mastery of trading.

When I first traded, I was mostly breaking even. There was not much gain nor loss at end of each month. Couple of hundreds gain this month only to lose a couple of hundreds in the next month. Then, I began to see the light. Somehow, they all began to fit and come together. I began to make money.

I felt like a money making machine for quite some time. I began to make the same amount that I was earning from my full time job. Then, it grew to twice the amount, thrice and on the peak of it, was five times more what my full time job was paying me. I was churning out an ROI of more than 20% per month. Yes, per month. No doubt, it was still a small capital base but the feeling was great. My trading funds just grew and grew.

You could feel the euphoria, when you finally found your own holy grail - a method that works for yourself. A method which promises you financial freedom. Finally, I see the promises of the treasures of the seven seas is realizing before me.

But then, our story has yet to end. I shall continue in the next article. Stay tuned. Hey, you! Yes you! Don't play with the remote. Haha. :)

(Marcus, yes, I m keeping the suspense alive :P)

~ to be continued...

As usual, you are advised to download the ebook(s) soonest possible before the link expires or removed. I m not responsible of providing fresh links if they are no longer working.

Monday, April 30, 2007

Ebook: Bollinger on Bollinger Bands

Previously I quoted the summarised rules of Bollinger Bands.

Now, the complete guide to Bollinger Bands is available - by the master himself.

Bollinger on Bollinger Bands.

As usual, you are advised to download the ebook(s) soonest possible before the link expires or removed. I m not responsible of providing fresh links if they are no longer working.

Sunday, April 29, 2007

Why do I trade? - Part 1 - Definitions

Few days ago, I made a post - Why bother to trade?

I structured the post in such a way, which I think depicts the truths of trading and also provocative. While the total number of comments reached 18 comments, as at the time this post is being made, there is only a handful of people who commented. Which, I appreciate the comments made though, I am disappointed at the number of people who actually commented.

For the benefit of everyone, I would be putting down the definition of investing, trading, speculating and gambling. They are my definition and by no means correct, but they re my definition which I use.

Graham has a definition too. Let's look at Benjamin Graham's definition first.

What do we mean by “investor”? Throughout this book the term will be used in contradistinction to “speculator.” As far back as 1934, in our textbook Security Analysis,1 we attempted a precise formulation of the difference between the two, as follows: “An investment operation is one which, upon thorough analysis promises

safety of principal and an adequate return. Operations not meeting these requirements are speculative.”

And also, the commentary,

What exactly does Graham mean by an “intelligent” investor? Back in the first edition of this book, Graham defines the term—and he makes it clear that this kind of intelligence has nothing to do with IQ or SAT scores. It simply means being patient, disciplined, and eager to learn; you must also be able to harness your emotions and think for yourself. This kind of intelligence, explains Graham, “is a trait more of the character than of the brain.”

I dislike the definition as it does not distinguish trading from investing. Trading would include

1) A trading system with more than 50% accuracy.

2) Emotional control - much like what is emphasized by Graham as well though a slight change is needed.

3) Discipline to carry out stop loss and to trade as per the trading system.

This would satisfy Graham's criteria for as an investment which "Promises safety of capital and an adequate return"

1. Why safety - Money management techniques would safeguard the trades/trader, limiting the exposure or risk taken. This is normally in two folds - one in the form of stop loss. Another is the size of the trade, hence no overtrading is done.

2. Adequate return - The system which has more than 50% accuracy. And with emotional control to execute the system, adequate return will be guaranteed over the long run. Law of averages promises this.

So let's return to my definition. But as I ve mentioned, they are my definition and by no means correct, but they re my definition which I use.

Investment - Long term venture with intention to purchase the business or part of the business. Mindset here is as a shareholder of the company. While a shareholder mindset investor may dispose the investment in short period, this should not be an active pursuit. An investor should have the mindset of letting the business grow, otherwise, he wouldn't venture into it in the first place. Having run my own business before, I could tell you from experience, a business needs time to grow, things definitely do not happen instantly. An investor should be able to see the long term prospect of the company and base his decision on that.

Trading - A short term venture whose intention is to capitalise on the short term swings of the market. There is NO intention to be a shareholder. Objective is speed - not being an owner. While a trader may go for long term, it should not be a buy and hold strategy. Otherwise, it would be an investment. Yes, a Turtle Trading strategy would be difficult to differentiate whether it is a trade or an investment.

Speculation - While many have their own definition of speculation, my definition is being an operator. By this I mean to be able to "control" or influence the prices of a certain stock and enticing others to jump in on the wagon would be considered speculation. This is a highly specialized area where enormous amount of cash meets with the highest degree of skills.

Gambling - By gambling, I refer to the 90% of the market population. By jumping into a counter just because it is climbing up or just because it has shed 60% of its value is gambling. Why? Under what basis does one know that the trend will continue or will reverse? Without proper technique, its a gamble as there is no analysis nor any work done to justify the entry.

Majority of people also merely follow a tip. That would be gambling - no analysis done on the individual's part - no basis other than following the recommendation. The gamble is that the recommendation is correct. That is gambling.

Note: Even if I give certain recommendation, do make your own analysis and then derive on your own decision - then it could be either trading or investing. If you do not conduct your own analysis to ascertain the true picture of it, you re merely gambling that my recommendation is correct. I am known to be wrong. Everyone is known to be wrong. I ve yet to met anyone to be 100% correct. Show me one person who is 100% right all the time, and I ll show you a liar.

Then there are those who claimed to be traders but do not have a trading system - then they re not trading, they re effectively gambling. Without a system that works with the Law of Averages, there is NO safety. Hence - gambling.

Therefore, if there is no money management techniques incorporated into the trade entry, its gambling as well - NO money management concept - NO safety - GAMBLING.

~to be continued...

Further reading suggested on previous posts:

Gambling; Buy, Pray and Hold; Investing and Trading

Of Trader and Gambler

Saturday, April 28, 2007

Ebook: Dr Alexander Elder 2

Here it is.

Alexander Elder - Entry & Exit

As usual, you are advised to download the ebook(s) soonest possible before the link expires or removed. I m not responsible of providing fresh links if they are no longer working.

EDIT: I forgot to give credit to Mr CS Ong for finding and sharing this ebook with me.

Thursday, April 26, 2007

The Yin & Yang of Candlesticks

Everything in the universe has a balance. And the balance is seen in yin and yang.

So does candlestick. To ease our memory of the patterns in candlestick, we need to understand the concept of yin and yang.

Let's take a look at this candle - irregardless of whether it is a black or white candle - is this a hammer or a hanging man?

Without knowing the previous trend, one would not know but to learn this, it is easiest to learn both together. Even Nison grouped them together in his book Japanese Candlestick Charting Techniques.

The hammer and hanging man can be recognized by three criteria:

1. The real body is at the upper end of the trading range. The color of

the real body is not important.

2. A long lower shadow should be twice the height of the real body

3. It should have no, or a very short, upper shadow.

The only difference is one appears on the uptrend, signalling potential downtrend; while the other is the exact opposite - appears on the downtrend signalling potential uptrend.

"What is in a name?" - Shakespeare.

But if you would really want to remember the name, an easy way is visualisation - for example, hanging man - I would visualise that to be hanging, one needs to be on a high position - so hanging man would be hanging on the uptrend, signalling on potential downtrend. Why signal potential downtrend? Well, after being hanged, one would be dead. Kind of obvious isn't it?

And if hanging man and hammer is the exact opposite and one has learnt the hanging man, what would be the hammer? Yeap. the exact opposite. Easy, isn't it?

Now look at the below, what is this - a Shooting Star or an Inverted Hammer?

Again the concept to learn is the same as the above illustration of the Hanging Man and the Hammer.

Hopefully this article would ease one's learning on the Candlesticks. Enjoy!

Why bother to trade?

Why do you trade?

I often ask this question and often I am being asked this question.

Of course, the common answer is - for the money.

Some - for the adrenaline rush.

Others - for a different reason.

For those who trade for adrenaline rush, well, I could only tell you that trading is not supposed to be exciting. Its a business, not a game. And it may cost you if you re merely in for the excitement.

For money heh? Why trading?

The path of a trader is not easy, there is no easy money. Why do you trade?

For money?

There are numerous means for money - from getting an additional part time job to some Multi-Level Marketing (MLM) schemes.

Compare a sure part time income to the risk you re taking in trading. Why trade?

Compare MLMs with their "proven" marketing plans with the risk you re taking in trading. Why trade?

Want to trade for a living? Compare the security of a fulltime job vs the risk in trading - why trade?

Then some would say, trading is easier than others.

Getting a part time job is tiring. After working for 8 hours, its already exhausting. Part time job? You're kidding me!

MLM? Same with part time job. Most people are only free during the nights. So I have to meet them during the night AFTER my 8 hour fulltime job? Then every week, there is some sort of motivation meeting among members? You're kidding me!

Trading is different, every day I just buy some stocks and then sell them at a profit.

Bad news, buddy. Trading is worse than any part time job or MLMs.

I mentioned about plans - having the importance of having a game plan:

Game Plan

Being Bold and Able to Be Bold

That requires time and discipline.

Every single night (or day) without fail, one needs to prepare for the next day's trade.

If you re unprepared, my advice is - don't trade.

Why? The price movements of the counter you ve selected should not surprise you. You do not the time nor the luxury to be surprised. Act. Act immediately. And how could one act decisively if there wasn't a plan made in the first place?

Compare that to a part time job, compare it to a MLM scheme. Would trading really be better?

You would see that trading requires more discipline and is more risky. So I don't get it, why bother to trade then?

I'm curious. Do share your views. :)

Wednesday, April 25, 2007

Ebook: Dr Alexander Elder

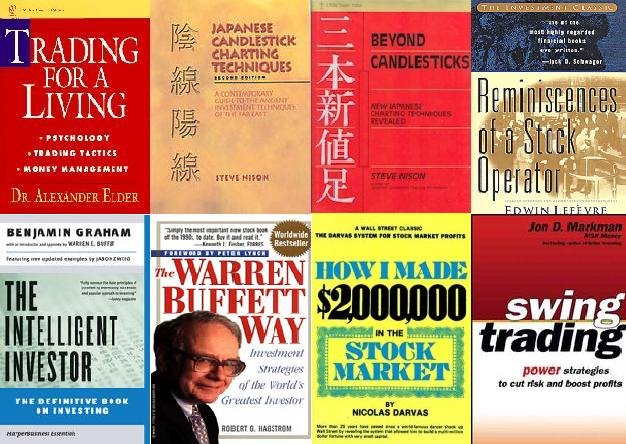

Dr Alexander Elder writes one of the best basic trading book covering from the right mindset, winning attitude, money management, and to essential technical knowledge.

Read all about it in Trading For a Living

After Trading For a Living, Dr Alexander Elder restrengthen and refortifies the principles to trading in Come to My Trading Room.

Maybe one still would have doubts. Perhaps Dr Alexander Elder is a genius. A rare exception. How could we mere mortals hope to emulate his successes? In the book, Study Guide to Entries and Exits, you will be shown to 16, yes 16 individuals who have different trading capitals base and levels of experience but are equally successful. They're all traders. :)

As usual, you are advised to download the ebook(s) soonest possible before the link expires or removed. I m not responsible of providing fresh links if they are no longer working.

Tuesday, April 24, 2007

Metastock Version 8.0

And so, many enquired as to where to download this.

I finally "found" a link which could resolve this issue.

The file is separated into two parts using Winrar. You ll need both the files.

Metastock v8.0 Part 1

Metastock v8.0 Part 2

Metastock v8.0 is the most stable version.

As per my previous post - Tools of Trade, you'll need to purchase the data from Bizfun.

Its only a one time fee of RM80.00. A superb bargain, I must add.

What can Metastock do for you?

1) Data at your fingertips - everyday download the data and extract it. Thereafter, you can manipulate the chart to your liking without an internet connection.

2) Custom Indicator - as you grow in TA, you may want to customise some of your own indicators. MS allows you to do it.

3) System Tester - Have a new system to test out? MS has a System Tester function which could test your system's success rate.

4) Exploration - How to shortlist the large number of counters in KLSE? Easy, insert the criteria you want and MS Explorer will do it for you.

5) Expert System - Here you can insert certain buy/sell signal or even a commentary.

The long and short of this is, MS is by far, the best charting software. Its versatility and user-friendliness is thus far, in my opinion, unmatched.

PS: As usual, you are advised to download before the link expires or removed. I m not responsible of providing fresh links if they are no longer working.

Monday, April 23, 2007

Being Bold and Able to be Bold

1) Entry position

2) Position sizing

3) Exit position

By having a trading plan, effectively, an individual has an added edge over the others. One would know what, when and how much to enter for a particular stock. The price is 0.50 now, should I enter now? The price is 0.49, is it now a bargain (since its cheaper than earlier 0.50) or does it render the plan null and void (since crucial support is broken)? I don't know, but your trading plan should already tell you that.

Ok, so we know whether we should enter or not. Question is how much? Should it be 1 lot? 5 lots? 10 lots? Should it be 5% of your funds, or 10% or 20%? Again, I don't know. Your trading plan should also tell you that.

Exit. Now comes the really difficult part. When to exit - irregardless of whether the exit is made on a profit or loss, when do we need to exit? If we purchased at 0.50, should we exit at 0.48 or 0.45? If the price moved to 0.60, should we take profit, or should we let it run?

Point is actually, when the market is ongoing, we barely have time to analyse or to think. Most of the work should have been done the day before. On the market day, we merely execute the plan - entry and exit should be planned. And when the time comes, we need to be bold to carry out the plan.

Say the plan calls for entry at 0.50, but we hesitate, the next moment, its going to be 0.52. Then, we ll tell ourselves, it ll pullback later, it will. But we re merely consoling ourselves. Price went up to 0.55. Should we still enter? Now its 0.05 or 10% higher than our original planned entry price. What do we do now?

Same with exit - whether its profit take level or stop loss - should we exit at 0.50 as planned? Heh, heh, I can tell you from experience, the moment we hesitate, the price is not going to go our way, its going for 0.48, the next moment we hesitate again, its going to be 0.45, and then 0.42 and lower and lower.

So be bold my friends. Be bold in taking and making the decision. And have the trading plan in hand - to be able to be bold.

"Boldness has genius, power, and magic in it. Begin it now."

- Johann Wolfgang Von Goethe

Sunday, April 22, 2007

Leading and Lagging Indicators

Mainstream wise, TA indicators are grouped into Lagging Indicators and Leading Indicators.

Lagging Indicators

Trend indicators fall into this category as they assist us in identifying the underlying trend based on past movement. This would include indicators such as Moving Averages.

As per my previous post - One shoe size fits all, I had a section on Crossover with Moving Averages as examples - terms such as Golden Cross and Dead Cross should be a familiar term.

When a Golden Cross appears, it is normally after the change of trend has already occurred fo sometime, ie, not the first sign of trend change.

Same goes to a Dead Cross, the downtrend is already obvious from the price movement itself - hence why it is labelled as a lagging indicator.

So since it is lagging, why do we need these Lagging Indicators? Well, actually, we don't really "need" them. However, they assist in helping us to "visually see" the trend continuation. As for trend reversals, they are confirmations that trend reversals has already happened.

These Lagging Indicators can also be used as entry points for Fundamentalists whose Trading/Investing Plan mainly focuses on FA. A simple TA method to use for Fundamentalist is actually Moving Average Crossovers. A reliable indicator for safe entry when the holding period is for the longer term.

Leading Indicators

Leading indicators are those which are used to predict price movement - or potential trend reversals. Indicators such as the RSI would fall into this category.

As per my previous post - One shoe size fits all, I had many sections which demonstrates how it could be applied in practice.

So why is this considered Leading? Well, the idea is that these indicators are supposed to be used to predict the future price movement - as the key reversal point are being formed.

However do take note that, Leading Indicators are best used in a Trading Range rather than a Trending Market. Sometimes, an oscillator can remain overbought or oversold condition for some time, remember?

So anyway, there, a summary of leading and lagging indicators. A trading system, in my opinion, should have a mixture of these two elements as they do complement each other. One to identify early trend change, another to confirm and provide continuation signals.