This write-up is credited to Blue who requested for it. :)

Before I begin, allow me to do a little background.

There are 3 major schools of investing:

1) Fundamental Analysis

2) Technical Analysis

3) Efficient Market Theory

Fundamentalist has long advocate that any purchase of securities (stock) should be based on its intrinsic value, or the true value of the company.

According to Investopedia, intrinsic value is the actual value of a company or an asset based on an underlying perception of its true value including all aspects of the business, in terms of both tangible and intangible factors. This value may or may not be the same as the current market value. Value investors use a variety of analytical techniques in order to estimate the intrinsic value of securities in hopes of finding investments where the true value of the investment exceeds its current market value.

Note the following:

1) Investopedia says, may or may not be the same as current market value, i.e. share price. Fusion Trader says, it will NOT be the market value. Market moves in accordance to the Supply and Demand. Not based on true value perception.

2) Investopedia says, it is based on the perception of its true value including all aspects of the business, in terms of both tangible and intangible factors.

Fusion Trader says, "Great definition. How are we to value these intangibles?"

Terminology: Tangibles are those with physical form. This would include assets such as Machinery, etc. Intangibles are those with no physical form. This would include assets such as Brandname, etc.

3) Investopedia says, value investors use a variety of analytical techniques in order to estimate the intrinsic value of securities in hopes of finding investments where the true value of the investment exceeds its current market value.

Fusion Trader says, "Would like to highlight the words - estimate and hopes."

Let's proceed to the many valuation models which could be used to estimate the intrinsic value. The list is not exhaustive.

1) NTA plus

NTA or Net Tangible Assets measures the balance tangible value of the company. Its main use is for safety reasons. It does not measure Intangibles, hence does not fully measure the intrinsic value. The idea is this:

Say, Company A is trading at 2.00 per share.

NTA is 2.50.

Undervalued. Buy.

Logic: Company's NTA is 2.50. And that is without the intangibles! Surely, if the intangibles are accounted for, it would be worth more than 2.50!!! What's more, the share price is only at 2.00!!! What a superb bargain!!!

Problem with Logic: Market is not based on Logic. It is based on Supply and Demand.

Problem with Approach: A self fulfilling prophecy. If all the market players uses this approach to invest in the stock market, it will work. If none uses this approach, it will stay as a "hidden gem" forever.

On another note. Some may think that should this company decides to close its operation, would it be an instant 0.50 profit? You bought it at 2.00 while the the NTA is 2.50.

Logically, the NTA means after liquidating all the assets and repaying all the liabilities, there should be a 2.50 per share sitting around to be distributed to its shareholders. So, if you bought it at 2.00, it wouldn't it be an instant 0.50 profit?

Sadly, I would have to burst your bubble. NTA is not NRV. NRV is the Net Realisable Value.

NTA is based on historical cost. Simply said, it means the cost of which it was acquired.

NRV is based on realisable value. Simply said, it means what you could sell it for.

Notice the difference?

2) Capital Asset Pricing Model (CAPM)

Investopedia says, it is model that describes the relationship between risk and expected return and that is used in the pricing of risky securities.

Its formula:

OK, you lost me :P.

3) Modigliani & Miller (M&M)

Investopedia says, it is a financial theory stating that the market value of a firm is determined by its earning power and the risk of its underlying assets, and is independent of the way it chooses to finance its investments or distribute dividends. Remember, a firm can choose between three methods of financing: issuing shares, borrowing or spending profits (as opposed to dispersing them to shareholders in dividends). The theorem gets much more complicated, but the basic idea is that, under certain assumptions, it makes no difference whether a firm finances itself with debt or equity.

Fusion Trader says, "Can't wait for it to get more complicated" :P

4) Black Scholes Model

For options, many experts, e.g. Alan Voon, the Malaysian Warrants Specialist, uses this model.

Investopedia says, it is a model of price variation over time of financial instruments such as stocks that can, among other things, be used to determine the price of a European call option. The model assumes that the price of heavily traded assets follow a geometric Brownian motion with constant drift and volatility. When applied to a stock option, the model incorporates the constant price variation of the stock, the time value of money, the option's strike price and the time to the option's expiry.

Also known as the Black-Scholes-Merton Model.

Fusion Trader says, I have the formula in my ACCA textbooks, but I seriously doubt anyone would be interested into it. The basic idea is good. However, too many subjectivity is involved.

For those who are interested, you can always refer to Mr Alan Voon. I think he wrote an article about this in his site - http://www.warrants.com.my/

If you don't understand what has been transpired so far, I congratulate you.

This is my whole point. I do not see the value of intrinsic value.

While many advocate looking for "hidden gems", I do not advise so.

I understand that my believe in this is radical to many traditional investing views.

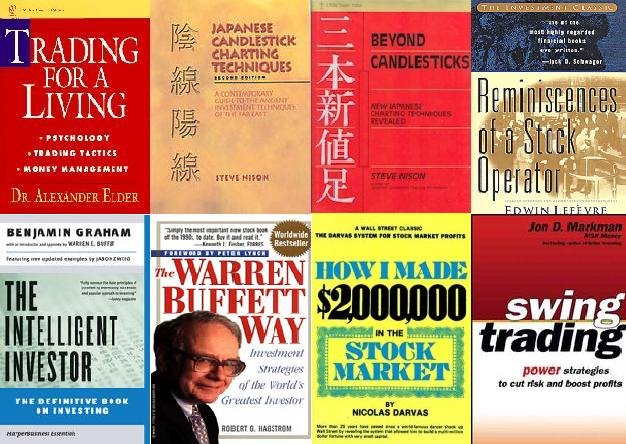

It would be a direct contradiction to Benjamin Graham, the father of Fundamental Analysis.

However, let me ask you a question,

"Was Warren Buffett, the World's Greatest Investor, the student of Benjamin Graham?"

"Who was more successful, Benjamin Graham or Warren Buffett?"

"Are their approach 100% the same?"

I am neither advising against using Fundamental Analysis, nor am I discrediting it.

To me, Fundamental Analysis is merely an additional tool. It tells us WHY should we buy.

I would rather use another approach - Technical Analysis to tell me WHEN to buy.

PS: Fusion Trader is an accountant, an investor and a trader. His views are formed based on his accounting knowledge, market knowledge and personal experience. His views may or may not be accurate. However, he speaks freely and candidly on his opinions. Feedbacks are always welcomed, irrespective of whether it is positive or negative in nature. Thank you.

24 comments:

Hm.. I was wondering. As a public investor, do we normally get to view a company's Cashflow Statement? Are we entitled to view such a thing? If so, where can we get such data? Coz I believe such data cashflow can really help determine the health of the company too.

Yes you are right. Cashflow is very important. Check out the company's Audited Accounts. You may obtain information from Bursa's website

http://www.bursamalaysia.com/

Not that I do a lot of valuation myself, but when it comes to valuation, I believe the best way of doing it is through the Discounted Cash Flow, or basically the PV of FCF, model to determine the value from the operations and then plus the value of other assets/investments then less minority interests/debt/liabilities.

The art of valuation depends on the understanding of the business, its industry and its general economic environment. The key difference between strong and weak analysts is their ability to forecast. After all any one can use models to value companies but models are just models, if you input weak forecasts then you get bad results. Garbage in, garbage out.

So, I would prefer to leave the forecasting and valuation part to the experts and track their work to see who are those better analysts and just keep track of their reports and analyses.

If you really want to DIY you own valuation to determine the true intrinsic value you obviously need a good understand of the business/company that you are investigating. I believe you can download their annual reports with audited accounts from the bursamalaysia website and probably some have their own corporate websites where you can download or requests them as well. But be prepared to do a lot of numbers crunching.

I am lazy, I look at charts ;P

TradeSignum.com

how come u delete others comment one, it is here not open for discussion? :P

wahahaah... all these methods, by best i choose CAPM... whahahahah....

actually still many field of investing techniques u can put in here, to make it complete..

such as:

behavioral finance...

quantitative method (regression, ARCH and e3tc)

and etc...

Intrinsic value

Twelve accountants will give you twelve different answers. How do you give a value to the management, special rights, monopoly control, brand name, patents, etc., for example. The best you can do is an estimated guess based mainly on its current earnings, prospective earnings and dividend payments and discounted cash flow.

Booffett,

Erm, I don't know who deleted the comment. Let me ask around and see how to find out. I think the poster deleted it himself/herself.

Like I said, I welcome all positive and negative feedback alike. I m here to learn too :)

CAPM? Haiyoh.... everyday Beta Beta Beta. Risk free rate - an assumption. Beta itself has a formula which also a lot of assumption inside. Matilor. How much want to ASS-U-ME? :P

Yeah, many others. None so far could achieve the objective :P. Too many subjectivity involved. Think I mentioned that the list is not exhaustive. :P

Marcus,

I have a problem with DCF. What is the discount rate that you are going to use? Or what is the discount rate that the experts would use?

Like you said, garbage in, garbage out. Discount rate plays a major role. Its the central factor in DCF. But it is all assumption. How does one know which assumption is correct?

Ben,

Agree with you. You put in 12 experts, 12 experts will tell you different answers.

Brandname, patents, special rights, monopoly control which have no ready market cannot be valued.

Management is subjective - cannot be valued.

Another one I d like to add is the strength of the marketing team. Cannot be valued. E.g. DIGI - Eversince taken over by Telnor, look at their marketing team! I mean look at the marketing ideas, promotions, campaign etc. Its all brand positioning. The strength of their marketing team cannot be underestimated!!!

However, we could not value that.

Thanks for the comments guys, keep it coming :)

Haha found out.

Marcus Fei said...

This post has been removed by the author.

March 24, 2007 7:59 PM

It was Marcus :P

Yeah, it was me, accidentally posted before finishing what I wanted to say.

Well, the discount rate is just part of the formula and every input has its own significance. You can use the weighted average cost of capital (WACC) as the discount rate. As long as you can get hold of the financial statements and identify the firm's capital structure and with a little bit of estimation of some market values instead of book value, you should be able to determine a fairly usable discount rate for that firm. I tend to think that forecasting the free cash flows themselves is much more of a headache as that will require some serious understanding of not only historical performance, but also the current business, its plans, the industry and economic conditions affecting the stability and grow potential where in intangibles like R&D, brand name, franchise, management strength all plan a part.

And exactly like Ben and you mentioned that different analysts will give you different forecasts, because it is very much an art in forecasting. At the end of the day, valuation, like economics, is not an exact science. And as I said, there in lies the skill that differentiate the great analysts and the mediocre.

TradeSignum.com

great article but too heavy for me, will just follow you..stick to TA...study of human activities :P

Don't think one would have time to do so much analysis... I akin that to "too many cooks sploit the soup" syndrome :)

I believe in simplicity and stick to TA/FA. TA encompass supply & demand behaviour. FA encompass how a company performs towards generating revenues (including branding, marketing, sales prowess) & profit (operational effective & efficiency & asset/liaiblities utilisation).

Cheers

tcg,

Intrinsic value is also an integral part of FA. Its just that personally, I do not see the value of intrinsic value - mainly because of time (as you mentioned) and another the said subjectivity which the value will be very different, even if use the same method.

Marcus,

Again, too much subjectivity.

WACC formula would require the cost of equity.

Cost of Equity would require Dividends per share of NEXT year, Market Value of stock which keeps MOVING, Growth rate of Dividends which is actually an AVERAGE.

Estimation of market values of the assets would be also an enormous task.

Free Cash Flow (FCF)? Yeah, real headache. Never came close to finishing even one :P

But correct me if I am wrong, FCF does not do much work on intangibles like Brandname, Special License etc?

Yes, it is a lot of work to do and not to mention to complete a sound FA you should probably visit the firm and interview the management, but I doubt the DIY average investor gets the opportunity to do that. That is why if you believe in value investing but do not have the skills or resources to DIY, I propose you find a solid fund manager and invest with them. Or at least subscribe to some good newsletters/reports by solid analysts. There are always some good ones if you dig deep enough.

And yes, it is all about estimation and how good you are at arriving at your estimated values, i.e. how much homework have you done and how much gut feel you have to justify your numbers. I reason that once you are experienced at analysing one particular industry and company, then your estimations will become sharper for other companies in the same industry operating under similar circumstances.

Well, not directly I guess, but I tend to take the intangibles into consideration in terms of barriers of entry, bargaining power, competitive advantage/edge, etc. among other things and in turn determine how likely a firm is to sustain/grow their revenues, profit margins and etc. and therefore finally the try to translate those thoughts into actual numbers.

Do correct me if I am wrong, I am no professional on such topic and just sharing my thoughts while we are still on the topic :)

Good points!

Good points!

Excellento from Marcus :)

Question: How do you place a value on say barriers to entry? I take into consideration, but never managed to place a value to it.

When I want FA I always get an analyst report. I got too little appreciation for formula to do my own analysis.

Well I do not place a value on them directly as well but they will be at the back of my mind when I try place a value on say expected revenue, growth rate, profit margin etc.

At least that is what I believe to be the case.

Understand.

So, could I conclude that there is no value in intrinsic value?

Er.. of course! It is your blog and it is your mind. You decide what you want to conclude :p

After all, we all should make up our own minds and our own opinions, is it not? :)

Aiyah.... apalah... make me sound like dictator. :P

Just want to know your opinion whether is there value or no value in intrinsic value?

So far, from the interesting discussion, looked to me like many points on no value to intrinsic value. Unless I read it wrongly?

Oh... no lah, where did I imply that you are a dictator? :p

Well, my opinion is that there is value in knowing the intrinsic value of the equities of a firm if you are an investor. If you are an investor who has a good idea of the intrinsic value of your stocks then short term fluctuations in the market do not mean much to you and in fact, the stock trading in the stockmarket might some times swing in the extreme and create opportunities for the value investor to buy the stock at heavily discounted price versus the intrinsic value of the firm. When that occurs and if your fundamental views of the firm remain unchanged then it might be a very attractive opportunity to buy the stock.

On the other hand, if you are an active trader, knowing the intrinsic value does not help much because as a trader timing is critical unlike the investor who have a long time for his/her views to be correct. Some traders do trade off FA data such as P/E ratios, dividend plays, quarterly earnings reports, analysts upgrades/downgrades, firm news events, etc., but trading off intrinsic value, i.e. buy when price drops below intrinsic value and sell when price exceeds intrinsic value, does not quite work for me because I believe there is a fundamental mismatch of timing as you are taking long term considerations to time short term market movements.

So in short, there is value to know the intrinsic value of the stocks if you are an investor but not so much if you are an active trader.

Good summary.

I think I ll leave it to that, else we ll go back to the circle where intrinsic value cannot be calculated nor be estimated reliably

Furthermore, intrinsic value method is in hopes that others place the same intrinsic value. Hence, a self fulfilling prophecy. And a trader must avoid using self fulfilling prophecy methods.

Sorry, not able to leave my mark on the blog to say thank you to Max.. for attending my enquiry on Intrinsic value. I have been having some trouble accession blogspot lately from China web, hope someone can help.

Now.. woooshh.. the FA is more complicated than I thought. Like what gklau said too heavy.. i think is way toooo heavy for me.. hard time catching up with the professional here :p Good discussions between Max and Marcus. All your efforts are greatly appreciated here. Thanks a lot Max, for making the learning journey more practicle for newbie like me.

Sorry, not able to leave my mark on the blog to say thank you to Max.. for attending my enquiry on Intrinsic value. I have been having some trouble accession blogspot lately from China web, hope someone can help.

Now.. woooshh.. the FA is more complicated than I thought. Like what gklau said too heavy.. i think is way toooo heavy for me.. hard time catching up with the professional here :p Good discussions between Max and Marcus. All your efforts are greatly appreciated here. Thanks a lot Max, for making the learning journey more practicle for newbie like me.

As mentioned by warren buffet the correct intrinsic value is actually the net present value.

All equity investment should benchmark against the value of bond in other to determine the intrinsic value the only diff is a bond had fixed term but equity no!

But it is alright to take approx value.

Post a Comment