Lets listen and watch the video clip of one of my favorite songs about money :)

You know, it never stop puzzling me, why people think the stock market is a place for fast easy money.

If it was so, then why are there poor people in Malaysia?

We have a stock market, we have all the basic necessities, I haven't heard of anyone dying of hunger in Malaysia, there are no real natural disaster in Malaysia (exceptions apply :P)

If you had read Livermore, the guy's puzzled too.

Let me quote an excerpt from Richard Smitten's How to Trade Like Jesse Livermore

Livermore believed that the game of speculation is the most uniformly fascinating

game in the world. But it is not a game for the stupid, the mentally lazy, or the person of inferior emotional balance, or for the get-rich-quick adventurer. They will die poor.

Over a long period of years, he rarely attended a dinner party including strangers when someone did not sit down beside him and inquire after the usual pleasantries:

“How can I make some money in the market?”

In his younger days, he went to considerable pains to explain all the difficulties faced by the trader who simply wishes to take quick and easy money out of the market; or through courteous evasiveness, he would work his way out of the snare.

In later years, his answer became a blunt “I don’t know.”

It was difficult for him to exercise patience with such people. In the first place, the inquiry is not a compliment to a man like Jesse Livermore who has made a scientific study of investment and trading.

It would be similar for the layman to ask an attorney or a surgeon:

“How can I make some quick money in law or surgery?”

It is simply hard work, constant study, discipline, and unyielding perseverance that leads the way to success in the stock market, as it does in any profession. But before we go further, let me warn you that the fruits of your success will be in direct ratio to the honesty and sincerity of your own effort in keeping your own records, doing your own thinking, and reaching your own conclusions.

You cannot read a book on how to keep fit and leave the physical exercises to someone else. Nor can you delegate to another the task of keeping your records. You must understand and follow faithfully Livermore’s stock trading system, and understand and combine all the aspects of Timing, Money Management, and Emotional Control, as set forth in these pages. Livermore could only lead the way, and he would be a happy man if through his guidance, a trader would be able to take more money out of the stock market than he put in.

This information is for that portion of the public that at times may be speculatively inclined. Some points and ideas are presented here that come directly from Livermore’s many years as an investor and speculator.

Anyone who is inclined to speculate should look at speculation as a business and treat it as such, and not regard it as a pure gamble, as so many people are apt to do.

If the premise that speculation is a business in itself, those engaging in that business should determine to learn and understand it to the best of their ability, using all the data available. In the forty years that he devoted to making speculation a successful business venture, Livermore was still discovering new rules to apply to that business. The stock market is a journey with no end.

On many occasions, Livermore went to bed wondering why he had not been able to foresee a certain imminent move, and awakened in the early hours of the ensuing morning with a new idea formulated, actually impatient for the morning to arrive in order to start checking over his records of past movements to determine whether the new idea had merit. In most cases, it was far from being 100 percent right, but what good there was in it was stored in his subconscious mind. Perhaps, later, another idea would take form, and he would immediately set to work checking it over.

In time, these various ideas began to crystallize, and he was able to develop a concrete method of keeping records in such a form that he could use them as a guide.

His conclusion was that nothing new ever occurs in the business of trading or investing in securities or commodities. There are times when one should speculate, and just as surely there are times when one should not speculate.

There is a very true adage that Livermore loved: “You can beat a horse race, but you can’t beat the races.”

So it is with market operations. There are times when money can be made investing and speculating in stocks, but money cannot consistently be made by trading every day or every week during the year. Only the foolhardy will try it.

So, there you go. Lesson from the Grandmaster himself.

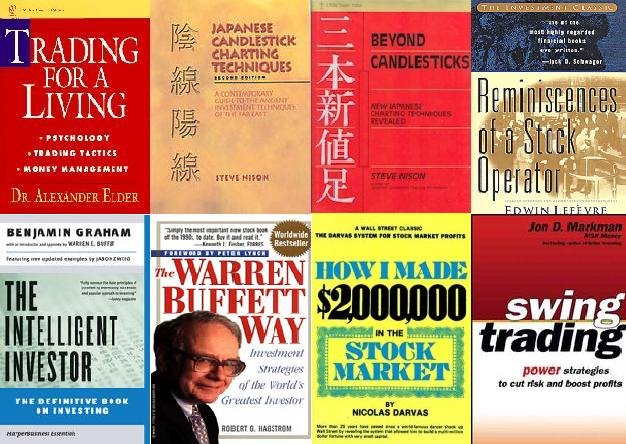

But before I get into trouble for publishing the excerpt, may I recommend that you buy the book. Its an investment :)

No comments:

Post a Comment